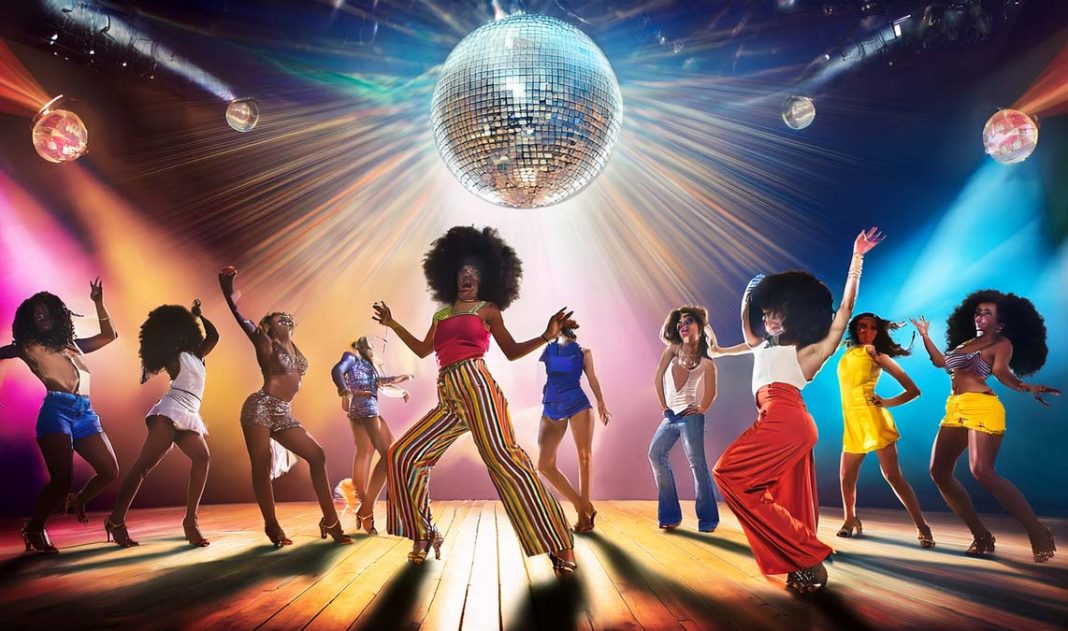

Turning 65 is a milestone worth celebrating—and what better way to mark it than by revisiting the disco classic Le Freak by Chic? While the funky rhythms of the late ’70s encouraged us to let loose and dance, this iconic anthem also serves as a playful metaphor for navigating one of the biggest transitions in your adult life: enrolling in Medicare. It may not sound as exciting as a night at Studio 54, but understanding your Medicare options is just as essential for keeping your life in rhythm.

Get Down With the Basics: What Is Medicare?

Before hitting the metaphorical dance floor, you need to know the rules. Medicare is the federal health insurance program for people aged 65 and older. It’s divided into different parts, each offering specific coverage. Although the terms might sound similar, each type serves a unique purpose—much like each instrument in a disco track.

Part A: The Steady Beat (Hospital Insurance)

Think of Medicare Part A as the steady drumbeat holding everything together. It covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care. Most people don’t pay a premium for Part A if they’ve worked and paid Medicare taxes for at least 10 years. It kicks in automatically when you turn 65 if you’re already receiving Social Security benefits.

Part B: The Melody (Medical Insurance)

While Part A keeps things steady, Medicare Part B adds the melody with coverage for outpatient services, doctor visits, preventive care, and durable medical equipment. Unlike Part A, Part B does require a monthly premium, and you must actively enroll if you’re not already receiving Social Security. Skipping it could lead to penalties—definitely not the kind of surprise you want during your encore.

“Freak Out!”—Choosing Between Medigap and Medicare Advantage

Now that you know the basics, here comes the real groove: choosing between Original Medicare (Parts A and B with an optional Medigap plan) and Medicare Advantage (Part C). This is where many first-time enrollees start to freak out—just like the lyrics say. But don’t worry. You can dance through it with a little help.

Original Medicare + Medigap: Classic with Backup Vocals

Original Medicare covers a broad range of medical services but often leaves gaps in coverage, especially for out-of-pocket costs. That’s where Medigap—or Medicare Supplement Insurance—comes in. It helps cover co-pays, deductibles, and coinsurance.

Medigap plans are standardized and offered by private companies. They let you see any doctor that accepts Medicare, without network restrictions. However, you’ll need to purchase a separate Part D plan for prescription drugs.

Medicare Advantage (Part C): Remix It All in One

Medicare Advantage, also offered by private insurers, combines Part A, Part B, and usually Part D into a single plan. Many plans include extra benefits like dental, vision, and even fitness programs. But there’s a catch—you’ll likely need to stick to a provider network, similar to an HMO or PPO.

This option is great for people who want bundled services and are comfortable choosing providers within a specific network. Just make sure to read the fine print, as out-of-pocket costs and coverage limits vary between plans.

Timing Is Everything—Like Dropping the Beat

Just as a disco DJ knows the perfect moment to drop the beat, timing your Medicare enrollment is crucial. There are three major enrollment windows to be aware of:

Initial Enrollment Period (IEP): The Grand Entrance

This 7-month window begins three months before the month you turn 65, includes your birthday month, and extends for three months after. It’s your best chance to sign up without facing penalties or delays.

General Enrollment Period (GEP): The Second Chance

If you miss your IEP, the GEP runs from January 1 to March 31 each year, with coverage beginning July 1. However, you may face late enrollment penalties, so it’s best to avoid this route unless absolutely necessary.

Special Enrollment Period (SEP): For Life’s Curveballs

If you’re still working and covered by an employer health plan at age 65, you might qualify for a Special Enrollment Period. This gives you eight months after losing coverage to enroll in Medicare without penalty.

Strike a Pose—Review Your Options Annually

Even if you nail your Medicare enrollment at 65, the dance doesn’t stop there. Every year from October 15 to December 7, the Annual Enrollment Period lets you switch plans, join a new Medicare Advantage plan, or add Part D coverage. Life changes, and so do your healthcare needs. Staying informed means staying in control.

Stayin’ Alive: Why “Le Freak – Chic” Still Resonates

Le Freak wasn’t just a chart-topper—it was a statement. A call to action. A reminder to own your moment. That’s exactly what Medicare enrollment is: an opportunity to take charge of your future, protect your health, and ensure peace of mind as you groove through your 60s and beyond.

Turning 65 this year? Whether you’re rocking platform shoes or sneakers, understanding your Medicare options is a step toward smarter living. And just like the rhythm of Le Freak – Chic, the key to Medicare is staying in sync, making informed decisions, and embracing each transition with confidence.